$1.9 Trillion in 19 sentences

A quick reference for the American Rescue Plan (ARP):

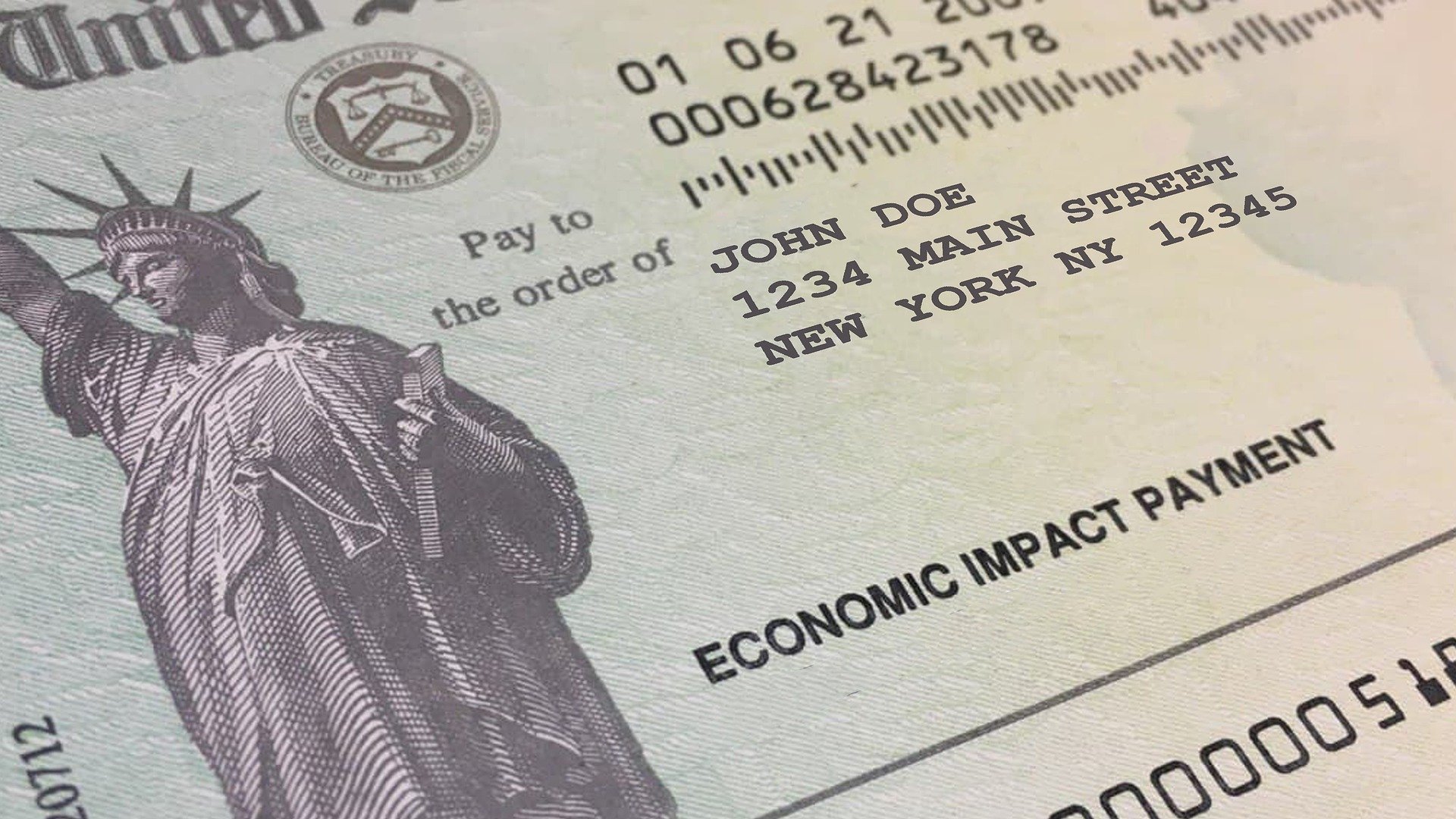

1. ALL dependents are eligible for the $1,400 stimulus payments with phase out ranges capping out at $80,000 for individuals and $160,000.

2. Some individual will receive their stimulus payments by next week, but there are several factors that determine this, either way tax day is still April 15th this year.

3. The ARP allows the first $10,200 in unemployment benefits to be non-taxable for people who made less than $150,000 in 2020.

4. Unemployment benefits will be extended until Sept 6. with a supplemental $300 on top of your regular benefit.

5. Full COBRA premiums will be paid from April 1st to Sept. 30th for those who have lost a job or had their hours cut.

6. Health insurance premiums will receive a subsidy through this plan for any coverage purchased through a government exchange.

7. The child tax credit has expanded for one year to include children 17 & younger, children under 6 can receive a $3,600 credit, while children 6-17 will receive $3,000 (Dependents age 18+ receive $500).

8. The IRA will pay out half of the Child Tax Credit on a monthly basis from July-December, meaning those who qualify will receive $300/$250 per month per child.

9. Individuals who make over $75,000 and couples making over $150,000 will not receive the child tax credit.

10. The Earned Income Tax credit will increase to $1,502 per year for those who qualify.

11. According to the plan, when calculating certain credits in the 2021 tax year, taxpayers are allowed to use their 2019 or 2020 income, whichever is lower.

12. Roughly $22 billion of the relief will go towards emergency rental assistance.

13. $10 billion will be provided to help homeowners with mortgage payments, utility bills, and other housing related costs.

14. Around $5 billion has been allocated to helping the homeless with another $5 billion used for emergency housing vouchers.

15. $350 billion will be provided for state, local government, territories, and tribal governments for vaccine distribution.

16. Nearly $130 billion will be dedicated for schools to keep staff and hire as needed to support changes and improvements over the last year.

17. Vaccine manufacturing and distribution will receive $20 billion.

18. $30 billion will be given in aid to help restaurants.

19. There were no changes to minimum wage or student debt forgiveness.