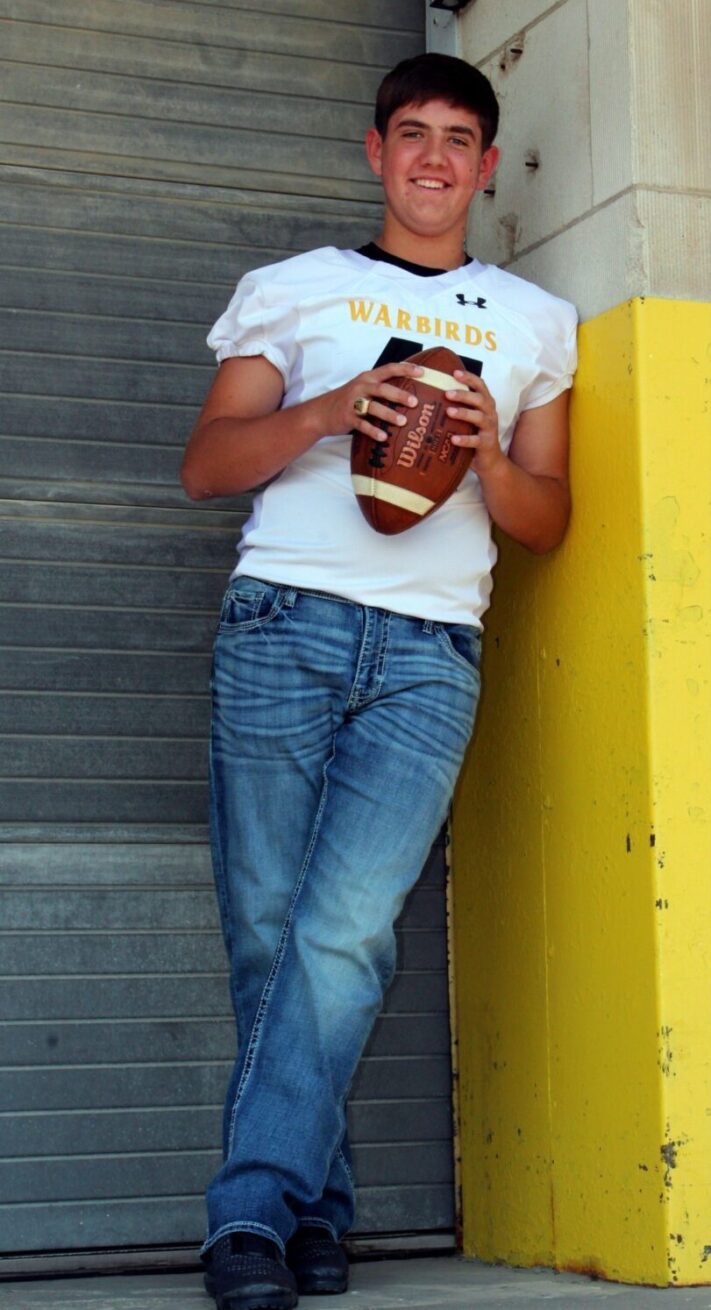

Christian Kinney – Elmbrook July Student Athlete

Student Athlete Spotlight CHRISTIAN KINNEY Brookfield Central High School Soccer GETTING TO KNOW CHRISTIAN KINNEY: Favorite Food: Chipotle bowls Favorite Quote: "Do or do not, there is not try." - Yoda Favorite Pre-game Song: Opposite of Adults - Chiddy Bang How did you get started in your sport? I was four-years-old when I first kicked a soccer ball around. I started playing recreationally and soon discovered this was my sport. Sport Highlight: During my junior soccer season, Brookfield Central qualified for state. This was a big achievement for