3 Things to Do with Your Investments During Stock Market Volatility

1. Plan – Make sure you know what your financial plan is and what you need your investments to accomplish. For instance, do you have 20 years until retirement? Then you ride out the current volatility. Are you in retirement? You might need some changes to insure income in the short term.

Developing a plan helps set your allocation and the risk you should take. Making emotional decisions on your financial picture, especially when there is so much uncertainty, is a tough game to win.

2. Strategize – If you do not have an investment strategy, it is time to develop one immediately. Perhaps you are a buy and hold investor, many of us are. We buy, make few changes and then ride out the turmoil. Over a long enough time period, you can bounce back from a down market.

You should not be buying or selling your stocks based on gut feelings or what happened during the day in the market. Human nature is reactive and in the investing world, that most often leads to you getting trailing returns.

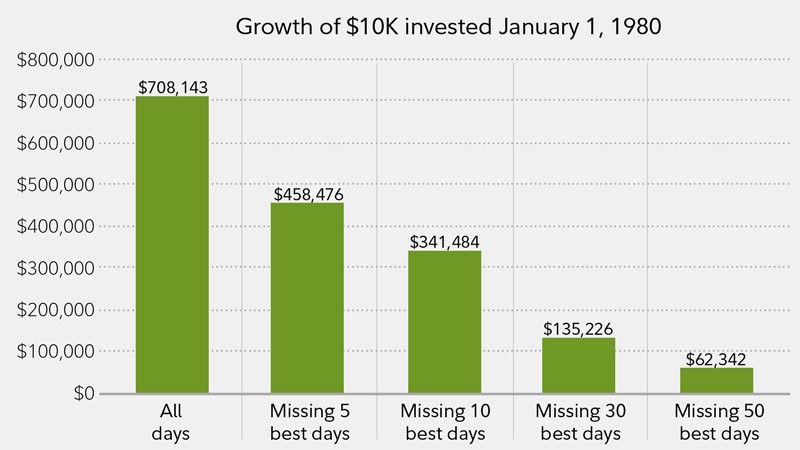

According to Fidelity, below is a $10,000 investment into an S&P500 index fund from 1980 to 2018 if you missed the best market days.

3. Financial Planner – Have you put off working with or hiring a financial professional? Now is a good time to jump in. Make sure you are working with someone who prioritizes planning and strategy. During this unprecedented time, if anyone claims to have the answers, they are lying. If someone says they have been in cash in preparation for a downturn, that means they haven’t been invested over the last few years when the stock market was rocking and rolling.

There are too many unknowns today to “know” what is going to come next. Coronavirus economics is brand new for everyone.

Could we dip back to the low in the market from last week? Maybe. Could this be around the floor for a couple weeks? We could see this being the case until we start to know more concrete data around the virus and the lasting effects.

Your best bets involve having a plan and an investment strategy to make fact-based, logical moves and adjustments as needed. We will get through this.

Jesse Niederbaumer

Vantage Financial Partner & Senior Advisor