Everyone’s a Genius by Andy Meyer

Vantage Partner & Senior Wealth Advisor (6 minute read)

“US Gov’t spending last 12 months: $8.1 Trillion. Yeah, like 40% of GDP. Actual fiscal deficit last 12 months: $4.6 Trillion. Yeah, like 20% of GDP. Another 10% coming soon through reconciliation, too. And infrastructure? Most important but always last. No end in sight.” – Jeffrey Gundlach

For months I have been telling clients and posting on my social media quotes like the one above or like this one.

“Once the US government finalizes and implements the next $1.9 trillion stimulus package, they will have increased the US dollar supply by 40% in the last 12 months. Think about that for a second. There will be 40% more dollars floating around the economy.” – Anthony Pompliano

It’s not because I am bearish on stocks or that I think the party is over. It’s actually the opposite. For many investors, young and old, if we’re talking about long term money, then a diversified stock portfolio is still your bread and butter. Should you own the same amount of Large Cap Tech as you did a few months ago? Maybe not, but that’s for another post.

As the world continues down its current path, we all need to understand a couple things.

First, we need to understand the game and the rules that are currently governing that game.

Second, we need to understand that both the game and rules can change at the drop of a hat – for or against our benefit.

For some investors, understanding the nuances of market cycles is easier, for others, perhaps more recent investors, it’s more difficult to connect the dots.

In the last 6 months, I have had two clients decide to manage their own investment accounts. For context, one is a millennial and one is a boomer – very different stages of life.

A couple important priorities our firm has is “fit” and setting clear expectations (for us and the client). We do not have the desire, capacity, or time to work with anyone and everyone. A big reason I love my job is I get to choose who I work with and help.

So, what caused their decisions? Why now?

It’s actually very simple, which is why I wasn’t surprised by their decisions.

They don’t understand the game, and they aren’t hip to the new rules.

In both cases, they had recently come into some money and opened new brokerage accounts outside of the accounts I managed for them. This is actually very common. But in this situation, this all happened post-March 2020, after US stocks experienced the fastest 35% correction in its history.

I think you know where I’m going here.

Since last Spring, just about anything and everything you bought is up, and most are up BIG. COVID demanded new rules and the government accommodated.

Interest rates went from low to the floor.

-This means money is basically free. Cost of capital = zero

The government began dropping money from the sky.

-Incomes have soared, due to stimulus checks and unemployment increases.

Retirement account owners, young and old, could tap their 401ks and IRAs without penalty.

-Last year you could withdraw up to $100k from your 401k to basically use for anything.

People didn’t have to pay taxes until July.

-More time to invest.

Borrowers and renters could pause mortgage and lease payments.

-These items are our biggest monthly expense.

Federal student loans didn’t need to be paid.

-More short-term discretionary spending.

Businesses had access to a new big pot of money.

-Paycheck Protection Plan (PPP) allowed businesses to continue to operate while not laying off workers.

Mortgage rates hit all-time lows while home values ski rocketed.

-Tens of millions of borrowers refinanced their mortgage and lowered their monthly payment.

-In the refi process, millions pulled out equity to spend.

I’m sure I’m forgetting a couple other contributing factors, but this is quite the list! Traditional stock market risk has been mitigated by a higher power.

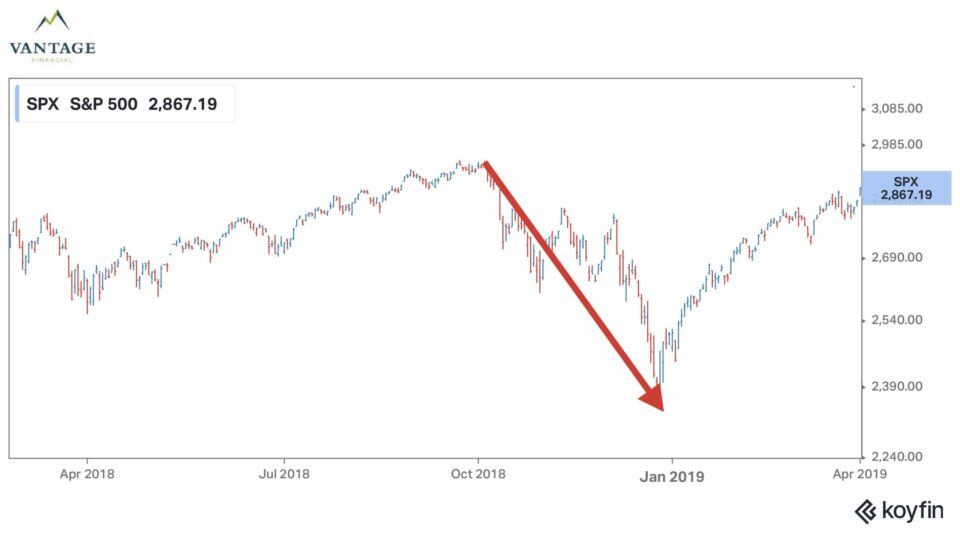

For a decade the game has been artificially low interest rates (cheap money for everyone), low taxes (more money to invest and spend), and increasing asset prices (an obvious result). The fed could not consistently hit their inflation target and unemployment almost evaporated. They tried to raise interest rates in 2018 and this happened.

If you are looking for another obvious example of how the rules have changed and the effect on the markets, look no further than SPACs. “A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company, also known as “blank check companies”(Investopedia).

Basically, these are piles of cash that famous people are taking public in efforts to capitalize on the current environment. Year-to-date we have seen 176 SPAC IPOs. Last year we had a total of 248 and in 2019 we saw only 59.

“These newer SPACs increasingly feel like an inside joke for the super-rich and a way for celebrities to monetize their reputations.” – Jim Cramer

Are we in an unusual time right now? Most definitely, yes.

Were the rules slanted in favor of stocks before COVID? Yes. Are they slanted even more now? Yes.

Let’s use an 18-hole round of golf as an example: Me vs Kevin, one of my business partners.

Kevin is a much better golfer than I am. His average score over 18 holes is probably around 78, give or take. Mine, 86ish.

With Kevin being the better golfer and a nice guy, he is going to give me 20 strokes. Meaning, for Kevin to beat me he must have 21 fewer shots than me. He is essentially allowing me 20 “re-dos” over the course of the round. How can I lose right?

On the front 9 holes, we both shoot our average.

Kevin = 39

Andy = 43

Now remember, Kevin is giving me those 20 “re-dos”. I use 10 of them on the first 9 holes, so by the way of the rules that turns my 43 into a 33. I crushed him by 6 shots on the front!

Well, I obviously feel great and personally responsible for that 33.

On the back 9, Kevin decides to be even more generous and allows me to play from the forward tee box. Now each hole will be shorter for me then Kevin, AND I still get those 10 other “re-dos” to use.

I think we can imagine how the back 9 went.

The first 9 holes = 2009 – February 19, 2020

The second 9 holes = March 23, 2020 – Present

I’m not a better golfer than Kevin.