Savings: Think Thousands, Not Nickels and Dimes (2.3 min. read)

By Ben Uphoff, Vantage Partner & Wealth Advisor

Business discussion groups we attend talk about the many tips offered for saving money in your budget. Problem is, these are “nickel and diming” options. Canceling Netflix, not going to the coffee house, and hyper frugal ideas like reusing baggies or home haircuts. Even with the best of intentions, implementing these hacks will have only minimal effect on you budget.

We want to consider ways of saving thousands, or even tens of thousands of dollars, to make a marked difference in the ability to save, invest, and earn interest on money in ways that will add up to being debt (and stress) free and ready for retirement in the time frame you’d hoped for.

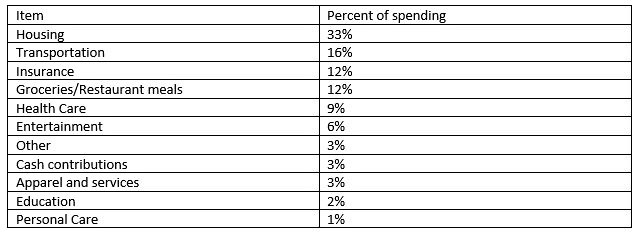

Based on data from the Bureau of Labor Statistics in 2019, here is the breakdown of an average American household’s budget:

Statistics show the average American spends around $5,000 per month. Reducing the biggest ticket items in your budget can have the largest effect. Housing, transportation, insurance, and groceries/dining attribute to 73% of household expenses. So, it stands to reason, reducing those categories of spending will give you more funds to save and invest.

Spending areas to review for biggest savings:

Housing: The Bureau of Labor Statistic numbers for housing include all components to living in a house (utilities, phone, furniture, trip lodging, etc.).

- Mortgage savings: A goal of saving tens of thousands over the life of the loan can be realized by refinancing. Check to be sure there would be no prepayment penalty. Compare mortgages with a shorter period, lower interest rate, and/or reduced mortgage insurance costs (or none). Factor in whether your earnings have increased, the value of your home has increased, or your credit rating is improved from when you acquired the current mortgage, and potential closing costs of possibly 2% to 5%.

- Phone costs: Most internet and phone companies are partnering to offer deals for customers, so it is worth an annual review to make sure you are getting the best deal.

- Electricity/Utilities: Energy efficient practices for your house sometimes have an upfront cost to help make your home more sustainable. A small expense to make your home more efficient can save you hundreds monthly.

Transportation:

- Vehicle purchase: The vehicle purchase amount or monthly payments account for 41% of transportation costs. A lower-priced vehicle with low maintenance costs could help you cut back substantially here.

- Gas and Oil: More than likely gas and gas tax prices will continue to rise in our lifetime. Consider a fuel-efficient or electric vehicle or carpooling.

Insurance:

- Bundle insurance policies: An annual audit of your home, auto and other insurance policies is another routine that you can adopt. If you are not getting the best rates on all, bundling can be a huge savings.

Groceries/Food Expenses:

- Meal prepping: A little work can go a long way towards saving both time and dollars. If you take the time to plan your meals for the week you won’t overbuy and you will have meals available to you that will save you from ordering out or going to a restaurant just for convenience.

As far as paying off debt, pay down the accounts with the highest interest first, and harness it for yourself!

Some math to inspire you: If you wanted to put $1000 away in savings in a month, you would need to save $33 a day or $250 a week. If you wanted to put $1000 away in savings in six months, you would need to save $5.50 a day or $42 a week. Maximize the $1000 in an interest-bearing savings account or move it into your investment account where it can begin to compound.

The moral of this simple tale? Enjoy your latte, you deserve it. Take time to pay attention to your biggest household expenses. Sometimes, there are upfront costs that stop us from exploring further what things will cost in the long run. Instead of nickel and diming, think about Grant and Franklin’ing.