Tale of Two Bears

I read an article in the Wall Street Journal by Jason Zweig this past weekend that put many things into perspective. The article’s title, “How to Survive a Bear Market,” naturally caught my attention since we’ve encountered the fastest bear market in history.

“A bear market is when a market experiences prolonged price declines. It typically describes a condition in which securities prices fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.”

– Investopedia.com

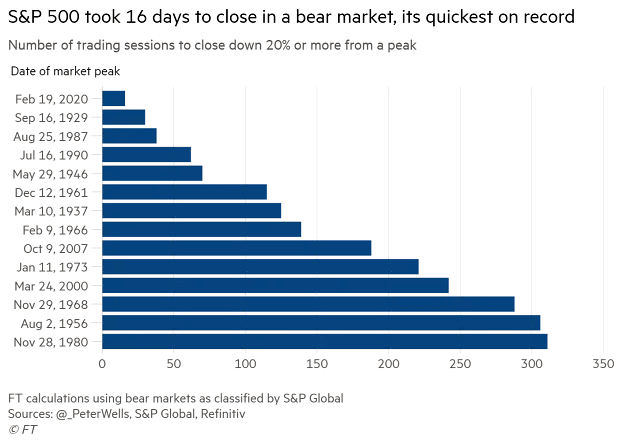

This chart shows just how quickly things have escalated. It only took 16 days to reach a bear market – the fastest in history.

So how can we survive a bear market? The same way we can survive a bear encounter in the woods -remain calm and do not make any sudden moves. This is great advice, especially since we talk with our clients daily about the same concept. The author also mentions that we need to make ourselves look as large as possible. We do this by taking another look at our plan and allocations and by keeping emotions in check. We often think all our investments are held in stocks when we also hold other assets such as bonds, which make our portfolios “seem bigger” since we do no not have as much exposure to stocks as we think in a bear market.

Additional sound advice if you ever encounter a bear – move slowly and sideways. This allows you to keep your eyes on the bear and avoid tripping. Never run from a bear! If the bear follows, stop and hold your ground. I look at how we can apply this advice to make the best of the current situation. Perhaps we do some tax loss harvesting or ROTH conversions. Maybe it’s time to look at positions we’ve held for a long time and have a discussion as to whether they are still a vital component to the plan.

The last piece of advice when hiking – travel in large groups because large groups are intimidating to bears. I feel this point might be the most important. Especially now. As we continue to social distance ourselves, the feeling of traveling this journey together might feel farfetched. But this is the time we need each other even more. Whether we are encountering a bear in the woods, or a bear stock market, or the COVID-19 virus, the best way to get through this is by doing so together. We cannot scare away a bear market by grouping together, but we can talk, listen, and act together to ensure the best possible outcome.

We are here for you. Please let us know how we can help.

Dan Sinnen

Vantage Financial Partner & Advisor

Additional Helpful Articles on a Bear Market:

https://www.kiplinger.com/article/investing/T047-C032-S014-5-things-to-do-in-a-bear-market.html

https://www.mdinvested.com/blog/four-ways-bear-market-similar-real-bear

https://drbreatheeasyfinance.com/how-to-overcome-bear-market-fear/