When Will the Game Stop?

by Andy Meyer, Partner & Senior Wealth Advisor

Welcome to 2021, a year where a social media platform can take a beaten down stock from $18 to $470 in less than 25 trading days.

What a week! The GameStop story is far from over, and although I’ll remain an intrigued spectator, it’s time to turn the calendar to February and see what other questions need to be answered.

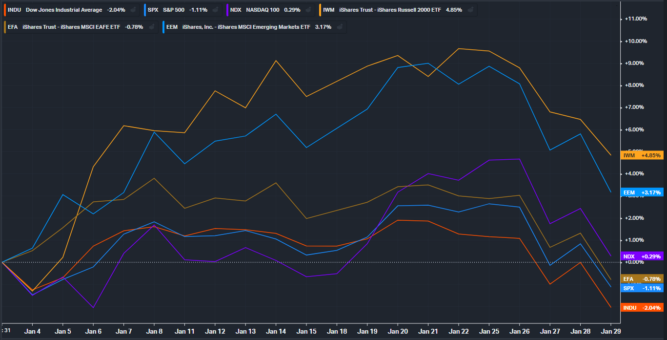

Before last week’s sell-off, Global stocks kicked off the year with a bang and rallied into the New Year.

So, what changed and where do we go from here?

Do we blame the volatility on the same crew that took GameStop to the moon?

- Volatility Index (VIX) spiked 62% last Wednesday, 3rd largest daily increase in history. is January a glimpse at what lies ahead in 2021?

Is the uncertainty around our battle with COVID still the market’s main concern? - There are now fewer than 100k Americans hospitalized with COVID for the first time in two months, BUT January was still the deadest month yet. How long can equity markets stay patient?

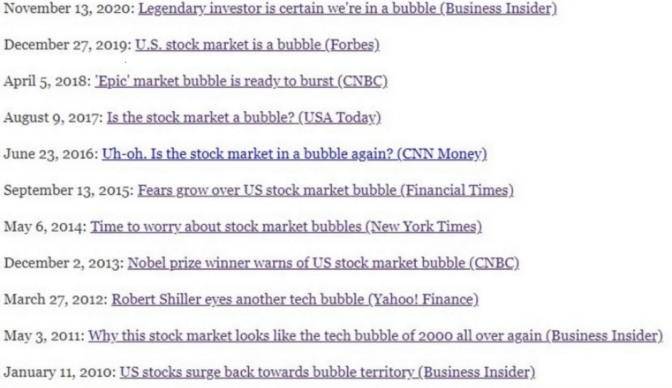

Is the stock market a bubble?

- Even after last week’s sell-off, the S&P 500 is up 66% from its March low and positive 11 of the last 12 years.

- 71% of companies beat their 2020 Q4 earnings estimates.

Will the next round of stimulus be enough?

- “10 senate Republicans announced a counterproposal to President Biden’s $1.9 trillion stimulus package, this one costing about $600 billion.”

- “Fourth quarter U.S. GDP growth disappointed estimates with a 4.0% annualized growth rate. Expectations were for a slightly higher 4.2% annualized figure but were weighed down by surging COVID cases through the end of the year.” – Chris Schuba, Helios Quantitative Research

Will the speed of the vaccine rollout slow down the economic recovery/reopening?

- “The pace of the vaccinations in the US is starting to pick up, averaging 1.3 million per day over the last week. With the approval of additional vaccines expected (Johnson & Johnson and Novavax reported results this week), this should only increase in the coming months.” – Charlie Bilello of Compound

Is all the “good news” already priced into these current stock prices? Is it time to sell?

- “Alan Greenspan first called the market “irrationally exuberant” in 1996 and the Nasdaq went on to rally another 500%.” – Morgan Housel

So, what did change? Not to dismiss the question or deflect, but who knows? The stock market is not the economy and there will always be plenty of reasons to make emotional investing decisions. Unless your risk tolerance aligns with day trading GameStop (or this week’s target – silver), it is best to stay unemotional and focus on your financial plan. For the same reason we didn’t get too optimistic following the first three weeks of the month, we keep ourselves from taking a turn to negative town following last week’s selling.

What didn’t change? At the January meeting the Federal Reserve announced that it is keeping interest rates steady (fed funds rate 0 to .25%). They will also continue their monthly bond buying spree while remaining patient around the topic of inflation. They are more concerned with the unemployment number and getting folks back to work than the potential for inflation.

Stay tuned. Stick to your risk tolerance. Diversify. Focus on what you can control.

Interest Rates and the Fed: https://www.cnbc.com/2021/01/27/fed-meeting-live-updates-watch-jerome-powell-speech.html

Vaccine Rollout: https://www.bloomberg.com/news/articles/2021-01-26/biden-team-tells-governors-it-will-speed-up-vaccine-delivery

Investing in a Bubble: https://mailchi.mp/verdadcap/investing-in-a-bubble?e=c416b31325

Stimulus Negotiations: https://www.npr.org/sections/coronavirus-live-updates/2021/01/31/962554923/10-senate-republicans-plan-to-detail-slimmed-down-covid-19-counteroffer

COVID-19: https://www.cnn.com/2021/01/31/health/us-coronavirus-sunday/index.html