Raising Money-Smart Kids

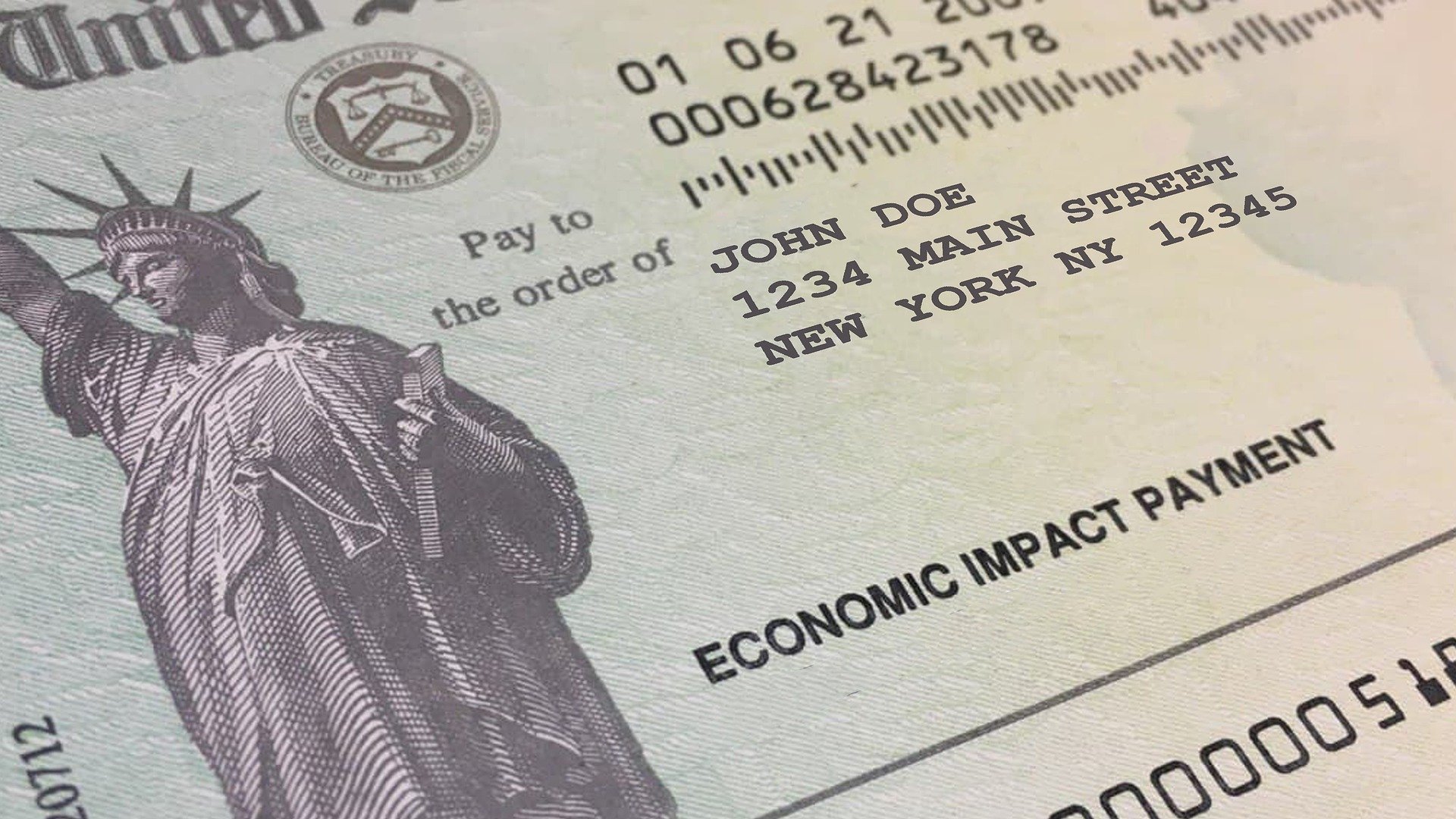

Raising Money-Smart Kids (2 minute read) To say that “times have changed” since boomers were children is a vast understatement. Now, twelve-year olds are using debit cards and apps to track their allowance, pay for things, and auto-deducting from their accounts. Even churches take cash-less, check-less offerings. And the impatient stares given at the grocery store to those paying by check? Awful. Here are a few tips on affecting change in personal finance education for kids, teens, and family members starting their lives independently – hopefully, without repeating some of our mistakes. 1. Be part of helping the schools