Planning Your Retirement Budget

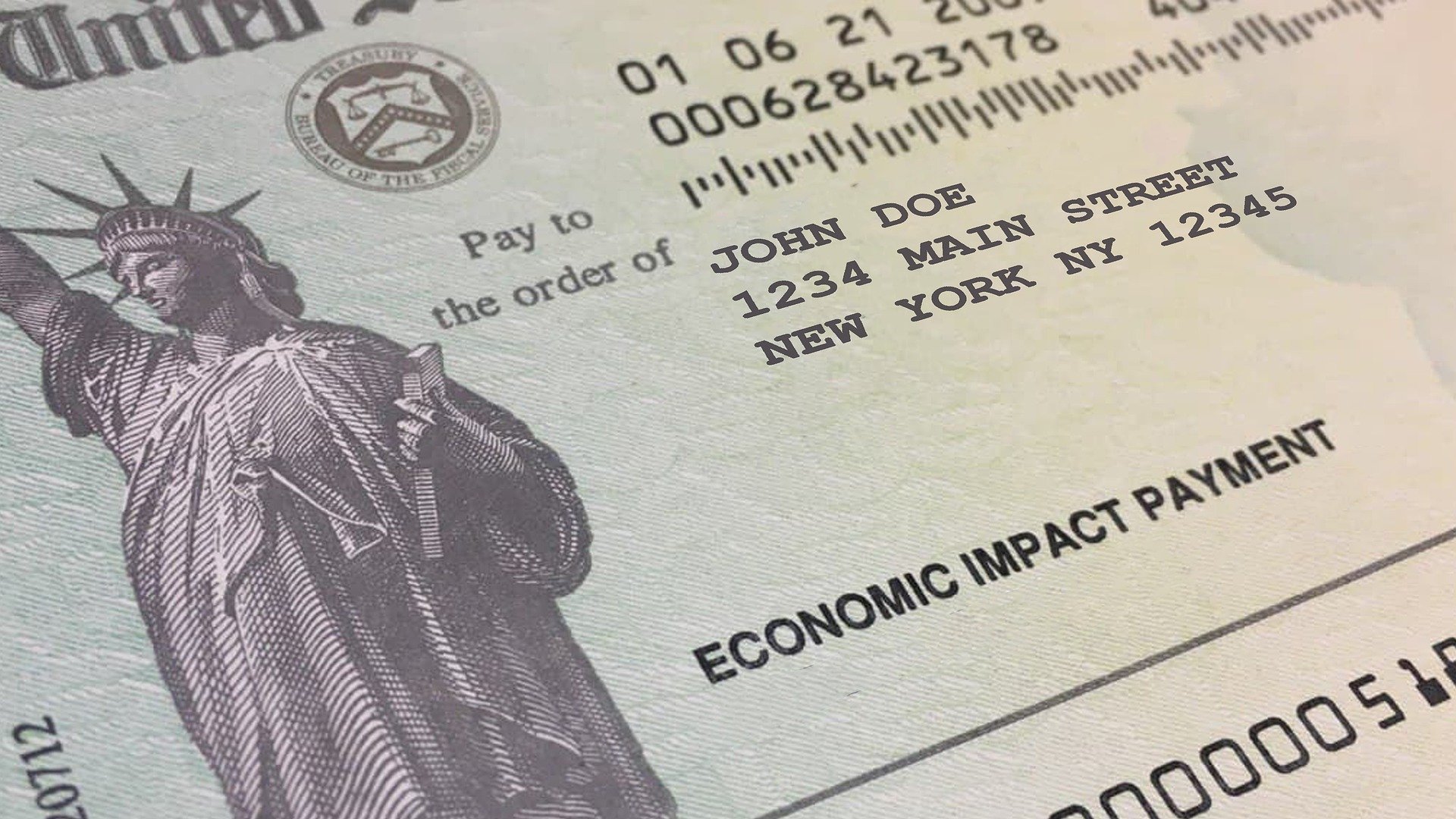

Planning Your Retirement Budget (2 min. read) For those on the cusp of retirement, or forced into earlier-than-expected retirement, you may have done some numbers in your head to figure out whether you will have “enough” saved and coming in (from Social Security, a pension, your 401K, or passive investments) to last through the golden years. According to the U.S. Census for 2021, the average age of retirement for men in the U.S. is 65, and for women, 62. The statistics vary from source to source, some say the average retirement age is 66. With people living longer due